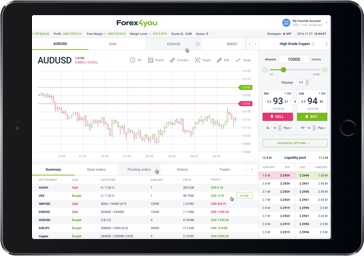

Forex4you Mobile

Forex4you is shaking up the world of mobile trading with our revolutionary app. Simple to use, with all the features you need.

Learn more

Get instant access to your funds now! No more having to wait for hours when you make withdrawals with Forex4you.

TRADE NOWRefer your friends and be rewarded with $50 bonus EVERY TIME one of them registers successfully!

Learn morePresenting the Introducing Broker (IB) and Multi-level programs

Find out moreTotal open accounts

Total orders executed

Open orders in market

Forex4you is shaking up the world of mobile trading with our revolutionary app. Simple to use, with all the features you need.

Learn more

This is the most popular professional Forex trading software available, with outstanding tools & features for trading and conducting market analysis.

Learn more

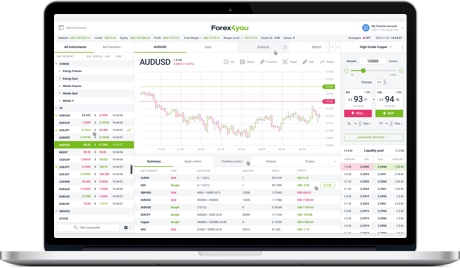

This is a unique and full-featured Forex trading web-based platform with a user-friendly interface.

Learn more

Our Forex trading installable platform for Windows and MacOS comes with a user-friendly interface.

Learn more

Share4you gives you the opportunity to multiply your income by becoming a leader on a Share4you social trading network. Get a second income for each lot copied from you. You set the amount of commission per copied lot from $2, $4, $6 or $8 per standard lot. The more followers that copy you, the greater your income.

Learn more about Share4you50+ currency pairs

Gold, Brent, WTI and more

15+ major indices

More than 50 companies

Atoz Awards

International Business Magazine

International Investor Magazine

The service is not provided in your country of residence.