Difference Between Bid Price and Ask Price

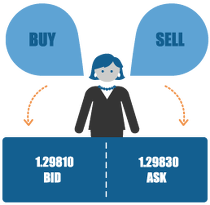

The Bid price represents the price a trader or an investor is willing to pay for the instrument being traded at that point in time. For example, when selling the base currency, the bid price is what the dealer is willing to pay to in order to purchase the base currency from you. The Ask price represents the price at which the trader is willing to sell the instrument being traded at that moment. For instance, when buying the base currency, the ask price is what the dealer is willing to sell you the base currency in exchange for the quote currency.

As you can see in the example above, the bid price will always be smaller than the Ask price. The transaction is always conducted on whichever currency that is quoted first. So you either choose to buy or sell the base currency.

What is a Long or Short Position?

When it comes to foreign exchange trading, the terms long position and short position refer to whether a trade initiated by buying first or selling first. A long position is initiated by buying with the expectation to sell at a higher price. A short position is initiated by selling, before buying, with the aim to repurchase the instrument at a lower price. To make it clear, consider the following example.

Long Position – Buying:

If a trader expects that the EUR/USD pair will rise in value, or in other words Bullish, he would open a trade by clicking on "Buy" and the trade will be triggered on the price of 1.2981. Traders refer to refer to this as "long" as they hope to benefit from an upward price movement (bullish movement).

Short Position – Selling:

If a trader expects that the value of the EUR/USD pair will fall, or in other words Bearish, he would click "Sell", and the trade will be triggered on the price of 1.2983. What he has done is known as a "short sell" position. He has actually sold something he owns so as to repurchase it at a smaller price and profit from the different price. Thus, if you short sell the EUR/USD pair and the price declines, you make money; if it rises, you lose money.

In conclusion, you should remember from this lesson that buying long is the most common method of investment in the forex market. There are many reasons for this, but the most important one is that the market pays quite well over time. Short selling is quite the opposite of buying long.