How to Use Take Profit and Stop Loss

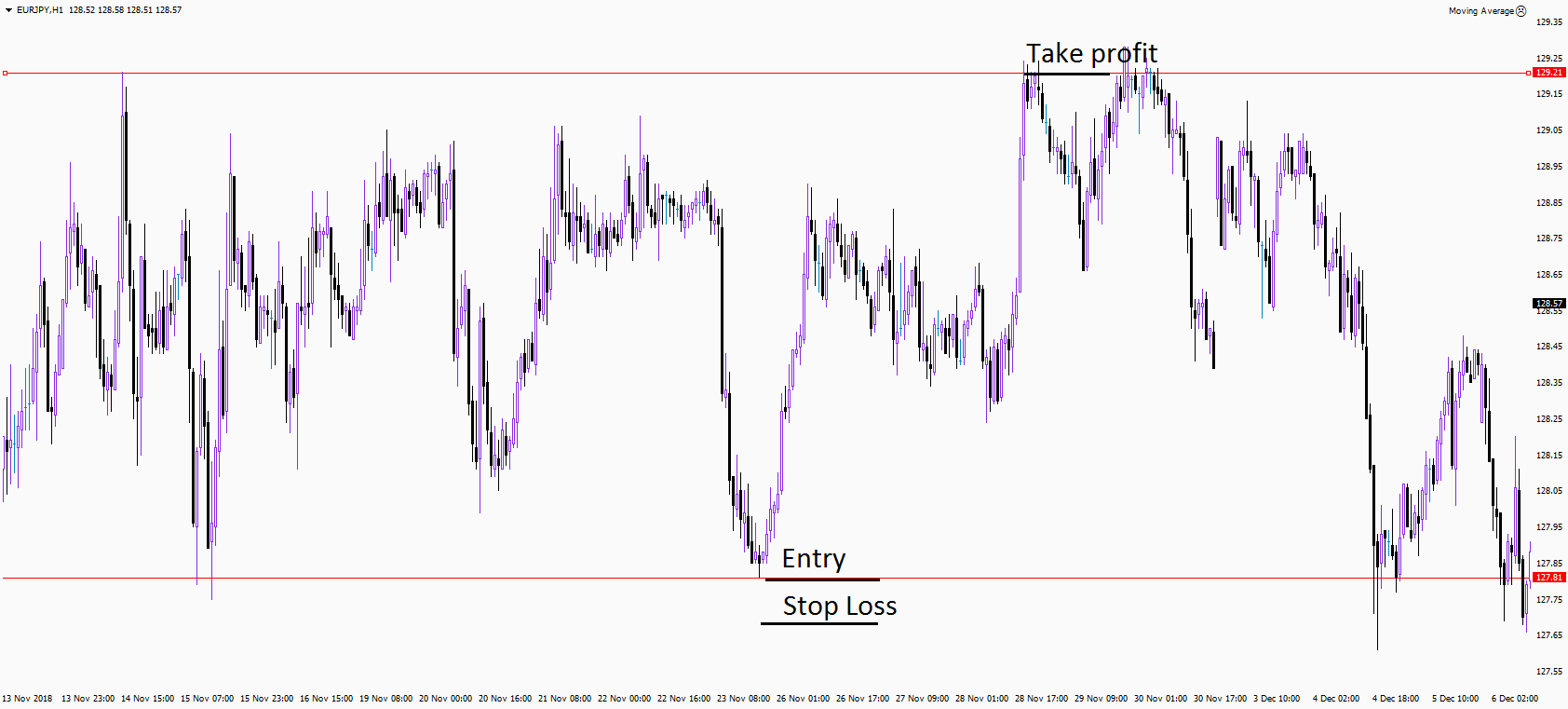

From a technical point of view stop loss and take profit are based on strong support and resistance levels. For trend trading support/resistance levels are trend lines, for flat trading – borders of the channel.

There is a simple logic behind this. A strong level of support or resistance will hardly break and the probability of a rebound from it is high. Therefore, the stop-loss should be set at the level of the previous maximum (minimum) in case of fake breakout. If the level of support (resistance) is broken, then the continuation of the trend, based on which we opened a position is no longer n issue. At the same time take profit is our forecast for the price to reach next level (channel boundary).

The same principle of placing stop loss and take profit is used in all types of trading. You can identify strong support and resistance levels yourself (previous local minimum and maximum) or by using indicators (such as pivot points. moving averages, etc.).

How to calculate Stop Loss and Take Profit levels

The size of a stop-loss is basically the amount that the trader is willing to risk in an open trade. According to money management recommended risk level should be 1-2% of the deposit for any transaction. For example, if trader’s deposit is $ 10,000. The trader set for himself the maximum risk of 2%. Accordingly, the loss on any particular trade should not exceed 10,000 x 0.02 = $200. Then a trader should evaluate the correlation between the size of his stop-loss, the price of one pip and the volume of the position. The trader has calculated that for a position at a given moment stop loss should be located 25 pips from the entry point. The cost of one pip is 200:25 = 8 dollars. Considering that the price of 1 pip is 10 dollars for 1 standard lot size position, trader gets the recommended position size of 0.8 lot. Traders should also keep in mind that there are spreads, which need to be added to your stop loss and take profit orders.