What Is the Spread?

The BID price is always slightly lower than the ASK price. So what is then the spread? It is simply the difference between the ASK or offer price and BID price. The spread represents a brokerage service costs and replaces transactions fees. It is traditionally denoted in pips – a percentage in point, which is the fourth decimal place in a currency quotation. You pay the spread every time you buy and sell a currency pair. You can think of it as a commission that your online broker charges you to trade. To understand it better, consider the following example.

Example:

If a currency has a certain price, for example GBP/USD = 1.5705, the broker will quote you a slightly higher price of 1.5706 if you're looking to buy. Should you want to sell the currency pair, they will repurchase it for only 1.5704. The value of the spread is thus equal to the difference between the bid price and the offer price.

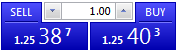

Below is another example of a EUR/USD quote that reads 1.25387/1.25403. Here, the spread would be 0.00016 or 1.6 pips.

In other words, there's a difference of 0.16 cents between what you pay to buy the same EUR/USD pair, and what you'd get if you were selling it. In case you sell the currency and decide to repurchase the currency you have just sold while the rate did not move a point, then the difference you will lose is the spread that is 1.6 pips in the given example. Although these values may seem insignificant, the smallest point change can result in thousands of dollars being made or lost when trading in large amounts.

There Two Types of Forex Spreads

Fixed Spread –

This is a constant price difference between the Ask price and the Bid price, and does not depend on the market conditions. The Forex broker artificially maintains fixed spreads.

Variable spread –

This type of spread fluctuates in correlation with market conditions. Generally, variable spread is low during times of market inactivity. However, during volatile market, variable spread can actually widen. While this type of spread is closer to real market, it brings higher uncertainty to the trades and makes the creation of an effective strategy more difficult.