Overview

The goal of a Forex trader is to make profit. To do so, one has to make wise trading decisions to reduce the risk of loss. That is where Forex market analysis helps. You can classify it into two main approaches: fundamental analysis and technical analysis.

For technical analysis, traders identify opportunities by looking at statistical trends. These include movements in price and volume. They also study charts for patterns that suggest future performance. For fundamental analysis, traders evaluate a currency according to its inherent value. They study the economy, from industry conditions to the finances of individual companies. There is no “best” practice between the two styles of analysis. In fact, traders often use a combination of both to gain more insights about the market.

For this article, we will focus on fundamental analysis. Here are some useful Forex fundamental analysis tools available to any Forex trader.

1. Economic Indicators

Economic indicators are reports that track the economic performance of a country. They are provided by governments or private organizations and released at scheduled times. They are often a good sign of whether the health of a nation’s economy is improving or declining.

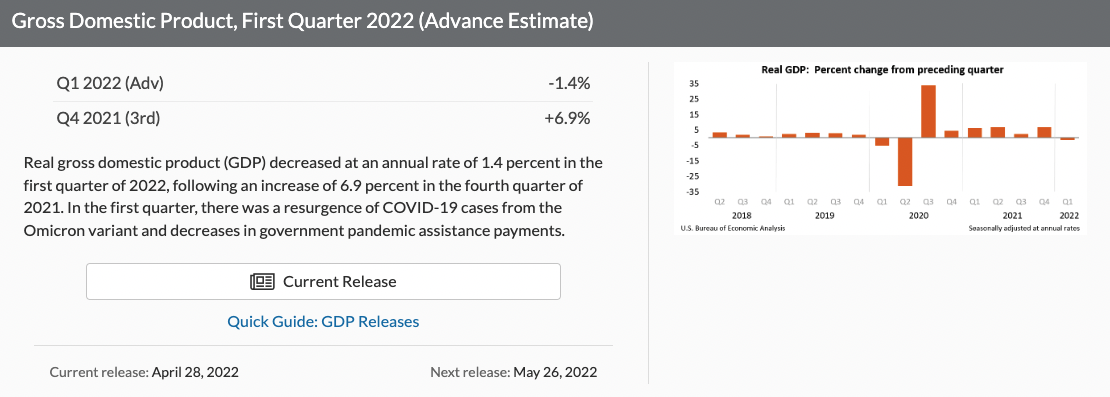

Some important indicators to watch out for are gross domestic product (GDP), unemployment rate, interest rate and non-farm Payrolls (NFP). These indicators are usually located on the official government websites of each country. Below is an example of the gross domestic product (GDP) for the USA during the first quarter of 2022.

Source: https://www.bea.gov/news/glance

2. Economic Calendar

The economic calendar details the dates of significant releases or events. These can affect the movement of individual security prices or markets as a whole. They include economic indicators like gross domestic product (GDP) and consumer price index (CPI). Jobless claims, reports of new housing starts, or reports from central banks are other things to look out for.

Overall, traders rely on the economic calendar for information to provide trading opportunities. They use it to plan trades and reallocate their portfolio. They also look out for chart patterns that may be caused or affected by these releases or events.

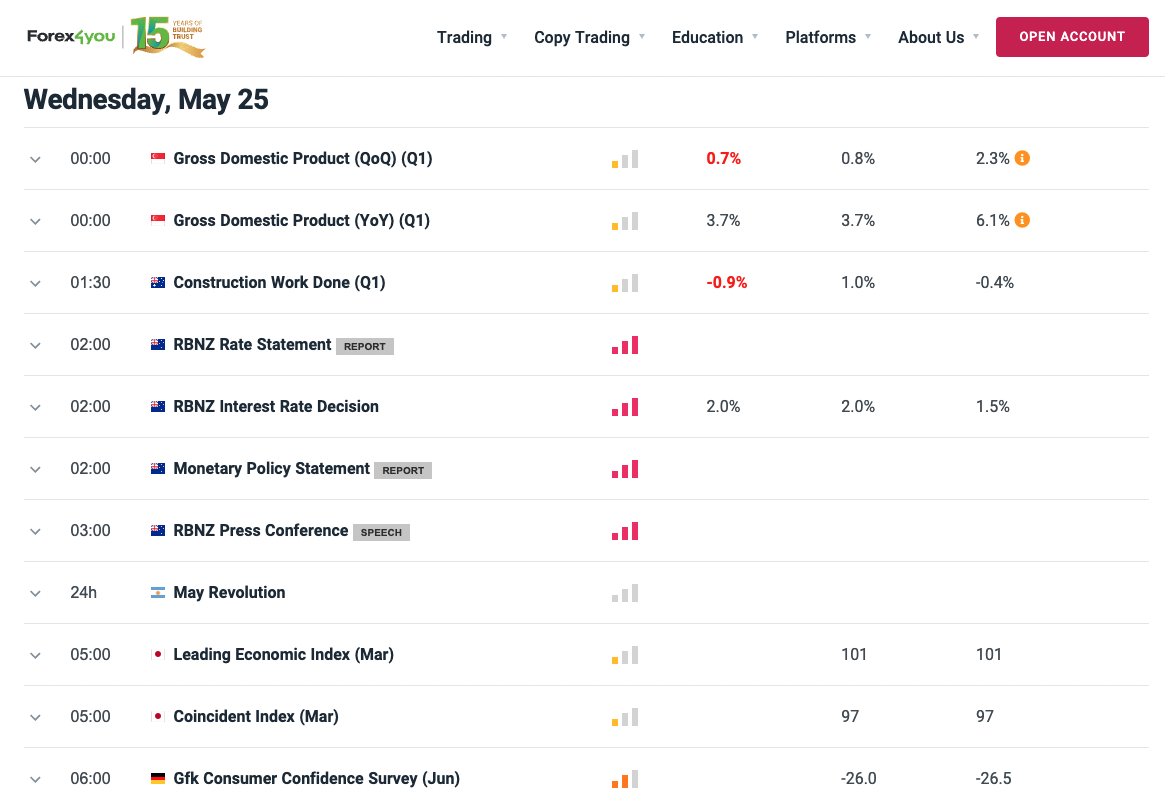

Many of these calendars are available for free on financial and economic related websites. Below is an example of the economic calendar on the Forex4you website. It is one of the most accurate and timely economic calendars on the Forex market.

Source: https://www.forex4you.com/en/economic-calendar/#why-should-use

3. Forex News Portals

Another important fundamental analysis tool is the news about the global economy. This is because economic news has a huge influence on many short-term movements in the market. The best part? They are available through TV, radio, online news portals and podcasts. The issue is that it can be a hassle trying to keep track of so many different sources.

In an ideal situation, economic news should be provided within your trading platform. This is something that Forex4you provides. Traders who use Forex4you also have access to direct market commentary of Trading Central one of the leading investment research providers of technical strategies. It is also a Registered Investment Adviser (RIA) with the U.S. Securities and Exchange Commission (SEC).

4. Propriety Fundamental Analysis Tools & Solutions

Many companies have solutions for rating the potential impact of economic indicators. Some even rate the impact of news items on a specific trading pair. But a drawback is that these solutions often come at a cost in the form of subscription fees. Also, while convenient, they are not always accurate. You should not rely solely on these solutions when making your trades. As a Forex trader, you should focus on the economic calendar, reports, news portals and a sound trading strategy. These are reliable and proven methods that allow you to sharpen and improve your analytical skills as a trader.

Summary

In summary, fundamental analysis offers an effective approach to studying the Forex market. But it does have its downsides as well. For example, fundamental analysis may show you that a particular currency is undervalued. But this does not guarantee that its shares will reach its intrinsic value anytime soon. In reality, price behavior is influenced by many factors and unforeseen events that can have an impact on the global economy. This would override any initial assumptions you may have made through fundamental analysis.

As mentioned, traders and analysts often use both fundamental and technical analyses to study the Forex market. This gives one a more complete overview when evaluating a company’s potential for growth and profitability.

Forex Trading involves significant risk to your invested capital. Please read and ensure you fully understand our Risk Disclosure.