All indicators are calculated by certain mathematical formulas, which use either price or trading volumes of a financial instrument. By using indicators, a trader can identify short and medium-term changes in price direction.

Furthermore, indicators can provide a trader with the following information:

-

Support and resistance levels (Moving averages, Bollinger bands, Envelopes, etc.)

-

Current market condition: trend or flat (Moving averages, Parabolic, Ichimoku, etc.)

-

Trend strength or momentum. If an indicator grows, it means that trend is actively developping and it is wise to make entries in trend direction. If an indicator falls, it means that traders start to lose interest in financial instrument and trend change may occur soon (momentum indicator)

-

Trading volumes (Accumulation/Distribution, On balance volume, etc.)

Different Types of Forex Indicators

There are many different types of indicators: volatility, trend, momentum, strength, and others. Yet, they all belong either to the laggards or to the leading group:

Lagging indicators follow trend and are called trend indicators. They have rather low prognostic characteristics. The most famous and widely used lagging indicators are Moving averages and Bollinger bands. The main feature of lagging indicators is that they work well in a trending market.

Leading indicators are often called oscillators. Those type of indicators are used to forecast trend reversals. Of course they cannot outrun price movements and appearance of new information on the market. They just have a slight forward shift, which gives you opportunity to forecast future market behaviour. Oscillators usually have more false signals than trend indicators. Most well known oscillators are Stochastics indicator and RSI.

Simple Moving Average (SMA)

One of the simplest well-known trend indicator is the Simple moving average (SMA). On the chart it looks like a line, which compares current price (closing, opening, etc.) with the past for a certain period of time (an average value). It can be used as a trend line, but in addition there are multiple other ways how this indicator can be used. Please refer to the lesson called ”Moving Averages in Action”.

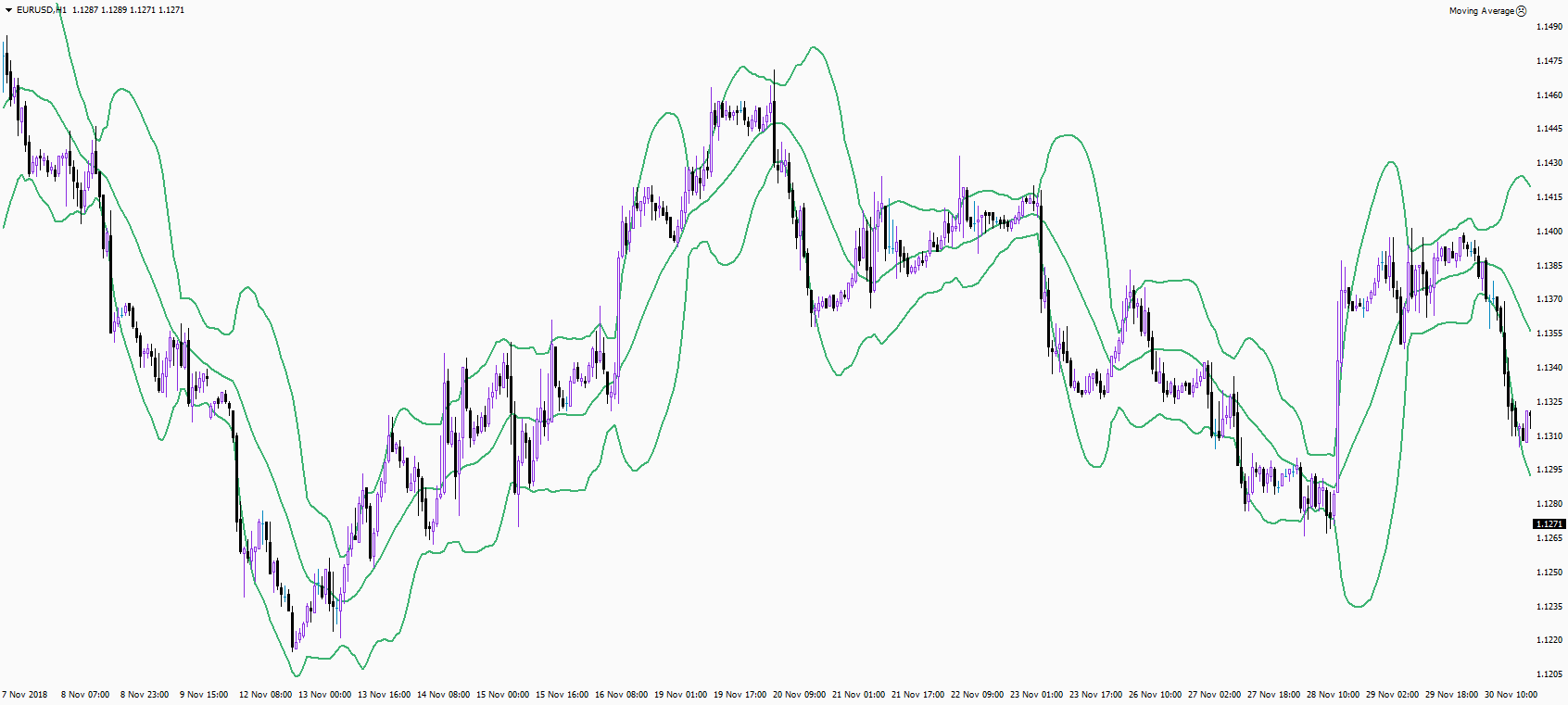

Bollinger Bands Indicator

Bollinger bands indicator perfectly shows volatility. The indicator consists of three lines:

-

Simple moving average (SMA for 20 days);

-

Upper band: SMA 20 + (standard deviation x 2);

-

Bottom band: SMA 20 - (standard deviation x 2).

Bollinger Bands is an ideal volatility indicator that cyclically narrows or expands, showing a wave-like price structure. After each channel narrowing, the expansion occurs and the price moves sharply up or down. Therefore, after each narrowing it is quite logical to wait for the expansion.

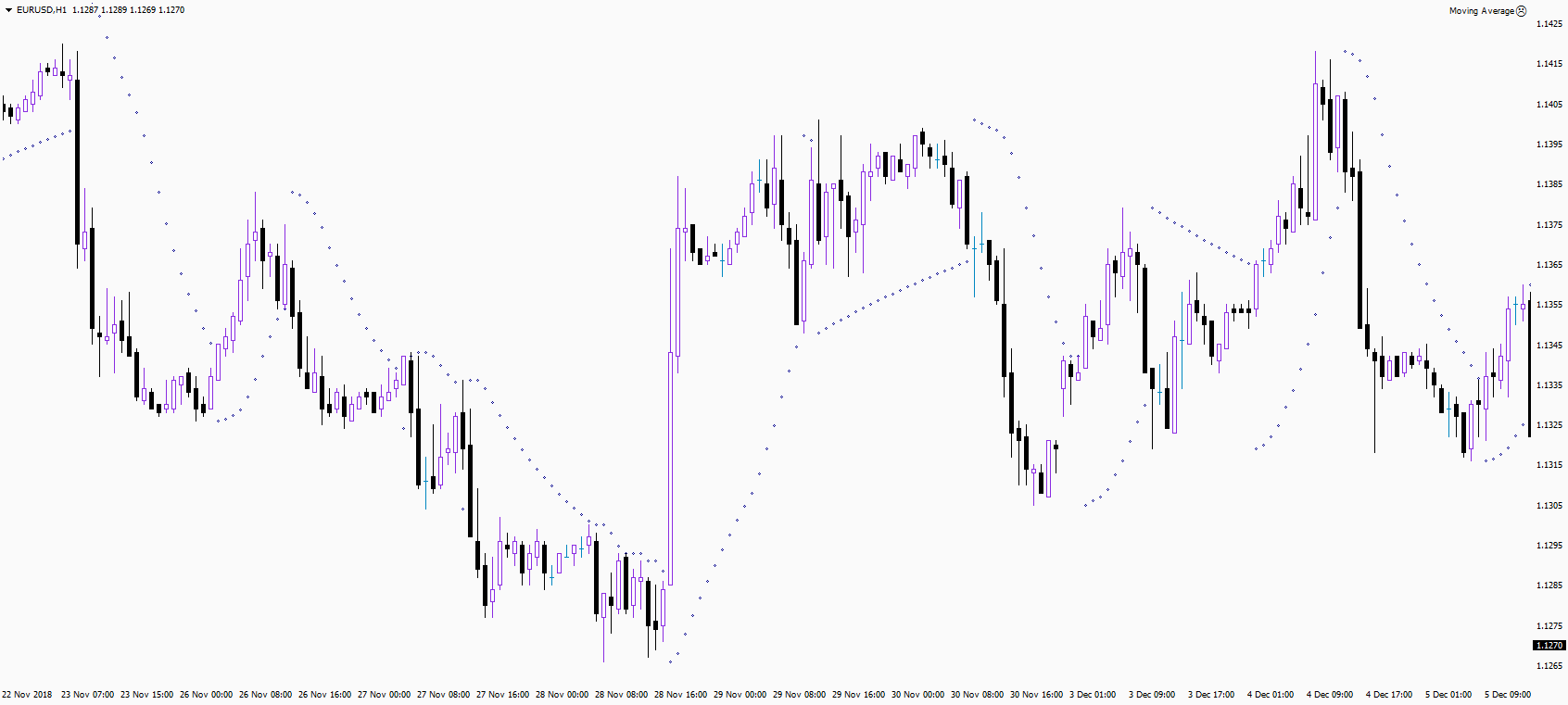

Forex Trend Indicator: Parabolic SAR

Parabolic SAR (Stop and Reverse) is a trend indicator, which is used to spot price reversals. The Parabolic SAR indicator gives the signals, as explained below.

Trend Confirmation:

-

Indicator is located below price chart, the indicator confirms the presence of an uptrend;

-

Indicator is located above the price chart, the indicator confirms the presence of a downward trend;

Definition of Moments of Closing Forex Positions:

-

Price falls below the indicator in an uptrend, long positions should be closed.

-

Price rises above the indicator in a downtrend, short positions should be closed.

Understand How Forex Indicators Work

Indicators are important instruments of technical analysis for an active trader. In order to start using one or another indicator, first it is necessary to understand how it works and what is it used to. Because depending on markets condition trend indicators, volume indicators or oscillators can be used. Once you have gained a proper understanding of the Forex indicators then it is time to start utilizing them. At Forex4you, you can get access to all the popular Forex indicators, in order to become more successful.