Using breakout strategy usually is much more effective when there is a clear trend, but it is less effective when used on flat markets. An entry is usually opened at the moment when price breaks through predetermined level of support or resistance. At the same time, a trader should calculate the minimum number of pips, which is required for him/her to suggest that the breakout happened. After breaking through, the price usually returns and subsequently rebounds from a previously broken level. At the same time, the support line is being transformed into a resistance.

Benefits of the Forex Breakout Strategy

The breakout strategy has the following advantages.

-

The strategy model allows you to make significant profits in a short period of time. This opportunity exists because when the price exits a sideways trend, it often is very volatile.

-

The strategy model uses a fairly reliable signal that allows you to determine price direction.

The above advantages are based on reflective nature of the market. When a signal appears many traders see it and by taking action they are strengthening volatility. Breaking the level of support or resistance is one of the most reliable signals (except trend reversal). The main disadvantage of such strategy is low efficiency when working on a flat market.

Analysis of the Two Breakout Trading Models

Let’s analyze the model of short-term breakout trading. Entry should be opened when price is 10-15 pips above (below) resistance level (support level). It is important to mention that exit from a narrower channel (up to 30 basis points) is carries higher profit potential. There are two tactics, which will help you to close an entry and determine a stop-loss order:

Buy and hold.

Short term trading.

Buy and Hold Tactic

The “Buy and Hold” tactic is based on the fact that the position should be held throughout trend duration. This tactic is used when there is confidence that the trend behavior will remain unchanged until calculated level (take profit level). “Buy and hold” tactics sometimes are called “strong nerves” tactics, since there is always a chance that the trend unfolds before reaching your take profit. That is why, in order to reduce the level of risk this tactic carries, it is recommended to use “trailing stop”. The main idea of Trailing Stop is to close a profitable trade at the moment when price starts to reverse.

Short-Term Trading Tactic

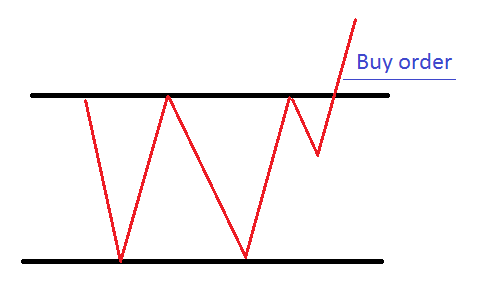

The “Short term trading” tactics is based on early closing trades. Trader closes open orders fast without waiting for a possible trend correction or its reversal. After closing one order, the trader can look for new entries at the moment when trend touches next level of support or resistance or breaking through it. A graphic interpretation of “Short term trading” is presented on the picture below.

The “Short term trading” tactics is based on early closing trades. Trader closes open orders fast without waiting for a possible trend correction or its reversal. After closing one order, the trader can look for new entries at the moment when trend touches next level of support or resistance or breaking through it. A graphic interpretation of “Short term trading” is presented on the picture below.

Practice shows that using “Short-term trading” tactics in most cases gives lower returns than “Buy and hold” tactics. At the same time “Short term trading” tactics carries less risk.